Highlights

In 2024, SIT returned:

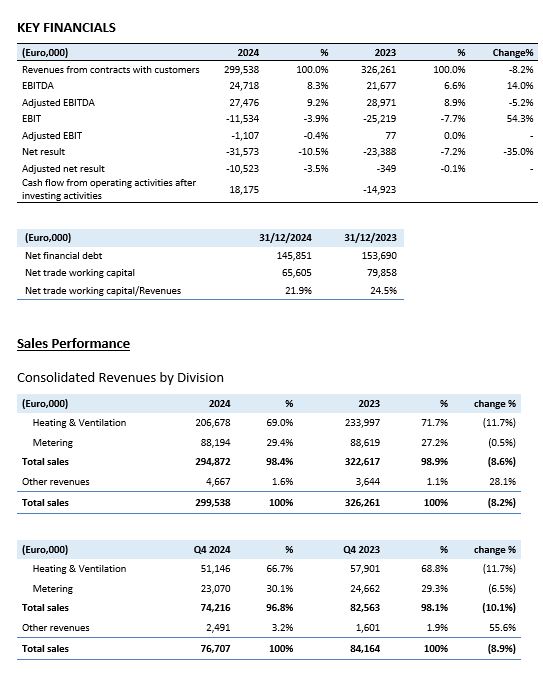

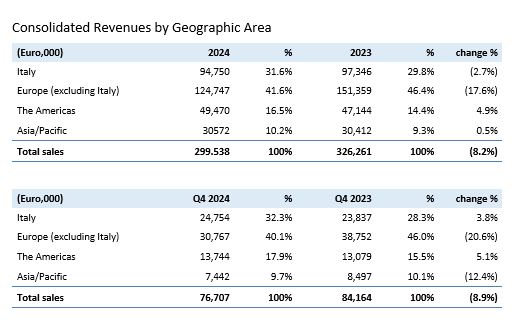

- Consolidated Revenues of Euro 299.5 million (-8.2% on 2023);

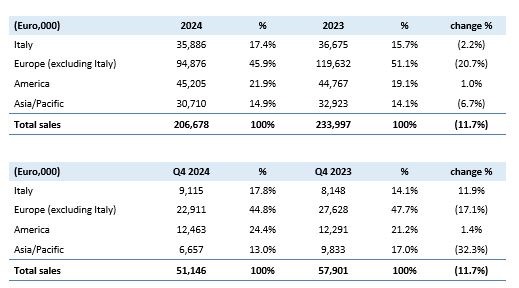

- Heating & Ventilation Division Sales of Euro 206.7 million (-11.7% on 2023);

- Metering Division Sales of Euro 88. 2 million (-0.5% on 2023), of which Smart Gas Metering Sales of Euro 58.0 million (-3.4%) and Water Metering Sales of Euro 30.2 million (+5.6%);

- Consolidated adjusted EBITDA of Euro 27.5 million vs Euro 29.0 million in the previous year;

- Consolidated adjusted Net Result of Euro -10.5 million vs Euro -0.3million in 2023;

- Impairment test on the division Heating & Ventilation resulted in a in a goodwill write-down of Euro 7.7 million and deferred tax assets of Euro 7.6 million;

- Consolidated Net Result of Euro -31.6 million vs Euro -23.4 in 2023;

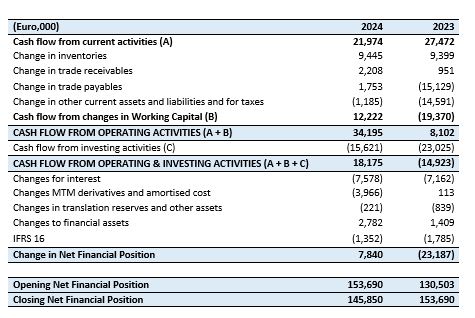

- Positive Operating Cash Flow for the year of Euro 18.2 million after investments of Euro 15.6 million.

- Net financial position of Euro 145.9 million, including Euro 11.7 million related to IFRS16, showing a reduction compared to Euro 153.7 in 2023;

The Q4 2024 results report:

- Consolidated Revenues of Euro 76.7 million, -8.9% compared to the fourth quarter of 2023;

- Heating & Ventilation Division Sales amounted to Euro 51.1 million down 11.7% on Q4 2023

- Metering Division Sales amounted to Euro 23.1 million, down 6.5% compared to the fourth quarter of 2023, including Smart Gas Metering sales of Euro 14.6 million (-5.6%) and Water Metering sales of Euro 8.4 million (-7.8%).

***

Padua, April 17, 2025 – The Board of Directors of SIT S.p.A., listed on the Euronext Milan segment of the Italian Stock Exchange, in a meeting today presided over by Federico de’ Stefani, the Chairperson and Chief Executive Officer of SIT, approved the consolidated results for the 2024 financial year.

Federico de’ Stefani, Chairperson and Chief Executive Officer of SIT, stated: ” Although our current performance has not yet fully aligned with our expectations, we have begun repositioning ourselves in high-potential sectors, bringing innovative technological solutions to the market that will start contributing to the Group’s results as early as 2025. In the face of ongoing geopolitical and economic uncertainty, SIT has focused its efforts in two main directions. On one hand, we have decisively and structurally reduced our cost base; on the other, we have taken strategic action to position our products in new sectors and markets. The effects of these actions have only partially emerged in 2024 and are expected to have an increasingly positive impact throughout 2025. The result is a much more resilient and competitive SIT.

It remains uncertain whether the market will return to its pre-Covid seasonality patterns this year, but we look to 2025 with optimism and are confident in our ability to deliver solid results. At a minimum, we expect SIT’s market share to grow, driven primarily by the launch of new products and the strengthening of strategic commercial relationships.”

Consolidated revenues for 2024 amounted to Euro 299.5 million registering a decrease of 8.2% compared to 2023 (Euro 326.3 million).

Consolidated revenues for the fourth quarter of 2024 amounted to Euro 76.7 million, down 8.9% compared to the same period in 2023 (Euro 84.2 million).

Heating & Ventilation Division Sales for 2024 amounted to Euro 206.7 million, -11.7% compared to Euro 234.0 million in 2023.

The following table shows the characteristic sales by geographical area of the Heating & Ventilation Division based on management criteria:

At the geographical level, Italy showed a growth of 11.9% compared to the same period in 2023, leading to an overall result for 2024 of -2.2% compared to the previous year.

Regarding Europe, excluding Italy, in 2024 accounted for a reduction in sales of 20.7% compared to the previous year. The annual comparison reflects a quarter trend heavily influenced by the first quarter, showing a gradual improvement over the year. Revenues were still affected by the significant uncertainty on regulations and incentive policies in a challenging macroeconomic environment in some major market (Germany and Central Europe).

The Americas reported quarterly performance in line with the full-year trend, with marginal exchange rates impact. Asia-Pacific region recorded a significant slowdown in the fourth quarter of 2024 compared to the fourth quarter in 2023 (-32.3%), mainly due to the performance of China and the Australian market. On a full-year basis, the region registered a –6.7% decrease, -5.4% at constant exchange rates.

Regarding the Metering Division, the fourth quarter of 2024 recorded a 6.5% decrease compared to the same period in 2023, with Smart Gas Metering down 5.6% and Water Metering down 7.6%. On a full-year basis, the division was essentially in line with the previous year. As of December 31, 2024, Smart Gas Metering showed a slight decline of 3.4% compared to 2023, having recovered most of the temporary delay reported in the previous quarter. Meanwhile, Water Metering achieved annual growth of 5.6%, confirming the solid fundamentals of the sector.

From a geographical perspective, Smart Gas Metering sales in 2024 were almost exclusively generated in Italy, while Water Metering sales were distributed as follows: 40.4% in Spain, 17.7% in Portugal, 24.7% in the rest of Europe, and 13.5% and 3.8% in America and Asia, respectively.

Operating performance

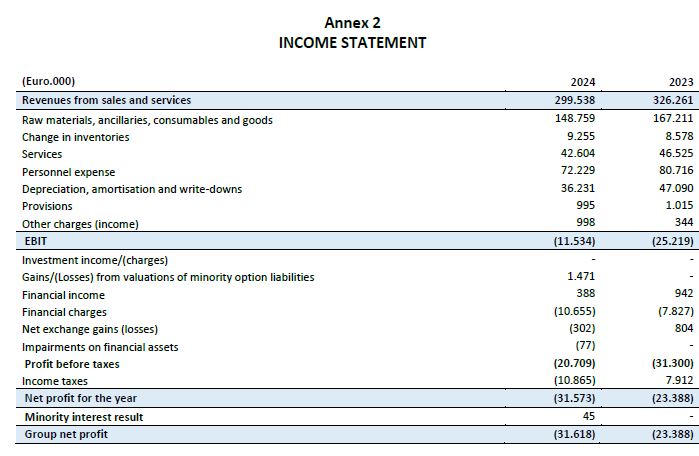

Consolidated revenues for 2024 amounted to Euro 299.5 million, recorded a decrease of 8.2% compared to 2023 (Euro 326.3 million).

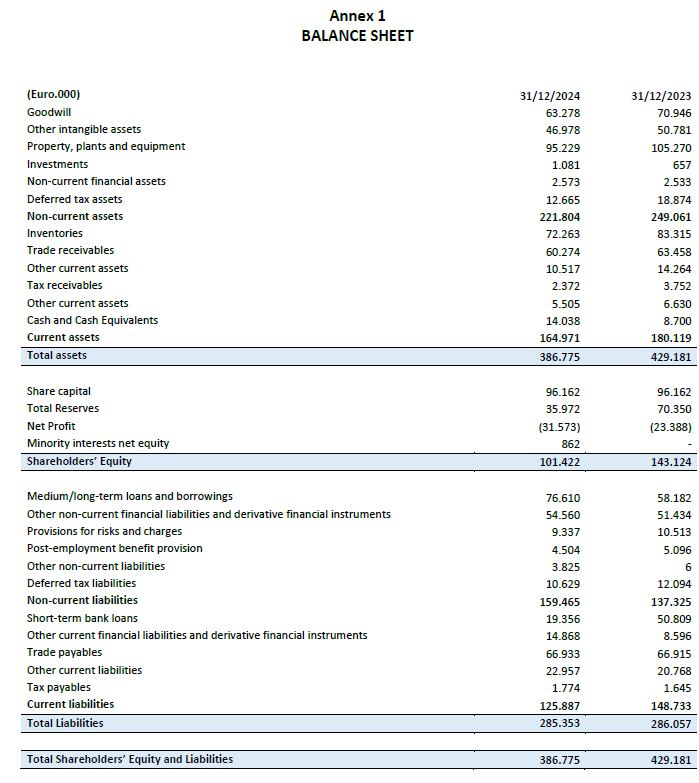

Purchase cost of raw materials and consumables, including changes in inventories, amounted to Euro 158.0 million, accounting for 52.8% of revenues, compared to 53.9% in 2023.

Service costs totalled Euro 42.6 million, down from Euro 46.5 million in the previous year, respectively amounted to 14.2% and 14.3% of revenues.

Personnel costs stood at Euro 72.2 million, down from Euro 80.7 million in 2023, representing 24.1% of revenues compared to 24.7% in the previous year. It is worth noting that 2024 included Euro 2.4 million in personnel restructuring costs, whereas in 2023 such costs amounted to Euro 5.3 million.

Depreciation and amortization, totalling Euro 36.2 million, represented 12.1% of revenues, compared to Euro 47.1 million in 2023 (14.4% of revenues). In 2024, the carrying amount of goodwill was adjusted with an impairment loss of Euro 7.7 million, following the impairment test conducted on the invested capital of the Heating & Ventilation CGUs. In the previous year, a comparable valuation resulted in a recognized loss of Euro 17.0 million.

Excluding impairment losses, depreciation and amortization amounted to Euro 28.6 million in 2024 and Euro 28.9 million in 2023, equivalent to 9.5% and 8.9% of revenues, respectively.

The operating result amounted to Euro -11.5 million (3.9% of revenues) compared to an operating loss of Euro 25.2 million (7.7% of revenues) in 2023.

The adjusted operating result, which excluded non-recurring charges and goodwill impairments, was Euro -1.1 million in 2024 and Euro 0.1 million in 2023.

Net financial charges in 2024 amounted to Euro 10.3 million compared to Euro 6.9 million in the previous year. It is noted that, during the period under review, it was necessary recognize, in accordance with the amortized cost criteria under IFRS 9, the financial impact resulting from the debt renegotiation agreement reached with the banking pool in 2024. This led to the recognition of a financial charge amounting to Euro 3.9 million.

The adjusted net financial charges, net of the aforementioned non-recurring items, amounted to Euro 6.3 million in the period, compared to Euro 6.9 million in the previous year, remaining substantially stable as a percentage of revenues (2.1%).

Based on the estimated recoverability of deferred tax assets, considering projected future taxable income, the Group prudently resolved — in accordance with IAS 12 — to partially impair the existing deferred tax assets related to deductible temporary differences, recognizing a loss of Euro 8.7 million. It should be noted that tax losses carried forward from previous years, as well as those accrued during the year, have been carried forward in compliance with applicable tax regulations.

As a result, taxes for the period amounted to Euro 10.9 million, inclusive of the above-mentioned impairment. Excluding this non-recurring effect, adjusted taxes for 2024 amounted to Euro 4.2 million, compared to the recognition of Euro 5.7 million in deferred tax assets in 2023.

The net result was a loss of Euro 31.6 million, compared to a loss of Euro 23.4 million in 2023.

The adjusted net result, net of the above-mentioned non-recurring items and tax impairment, shows a loss of Euro 10.5 million, equivalent to 3.5% of revenues, compared to a break-even result in the previous year.

Cash flow performance

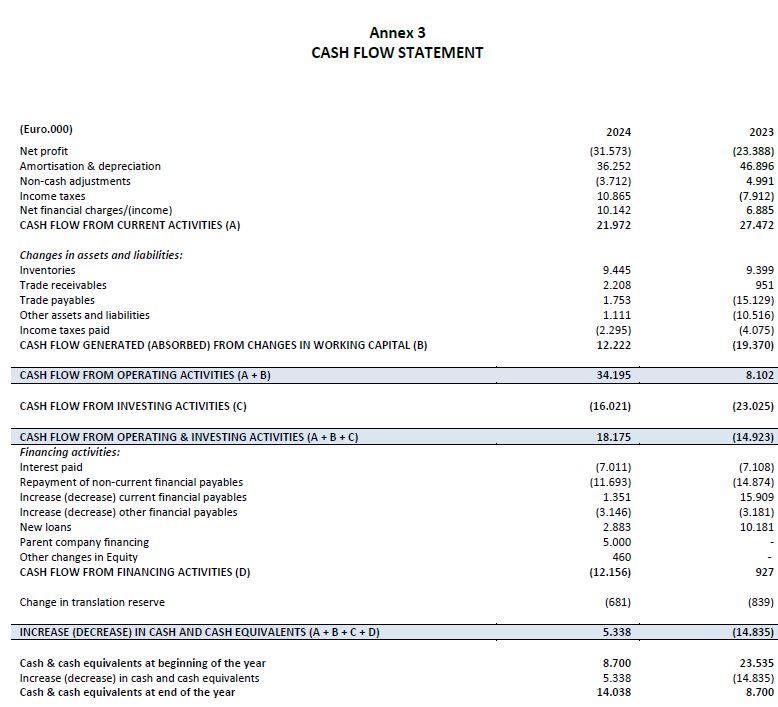

As of December 31, 2024, the net financial debt amounted to Euro 145.9 million, down from Euro 153.7 million recorded in 2023. The evolution of the net financial position is shown in the table below:

In 2024, cash generated from operating activities totalled Euro 22.0 million, compared to Euro 27.5 million in 2023.

Working capital generated Euro 11.8 million in 2024, reversing the absorption of Euro 19.4 million recorded in 2023 — a year impacted by a one-off commercial transaction with a customer and changes in factoring policies.

Commercial working capital flows contributed positively for Euro 13.0 million, mainly driven by the improvement in inventory management (Euro 9.4 million), consistent with ongoing efficiency and optimization policies, particularly within the Heating & Ventilation and Smart Gas Metering divisions.

Cash flow from investing activities totalled Euro 15.6 million, compared to Euro 23.0 million in 2023.

As a result, operating cash flow after investments was positive for Euro 18.2 million, compared to a negative Euro 14.9 million in the prior year.

Within financial activities, the Group recorded interest expenses of Euro 7.6 million, and MTM/amortized cost adjustments of Euro 4.0 million, mostly related to the recognition of the cost from the banking renegotiation, accounted for under IFRS 9.

Net debt was therefore reduced by Euro 7.8 million during the year, from Euro 153.7 million in 2023 to Euro 145.9 million in 2024.

Significant events after the reporting period

In January 2025, through its subsidiary Metersit, which operates in the Smart Gas Metering segment, SIT signed a multi-year contract worth over Euro 20 million with one of the leading European energy companies for the supply of residential smart gas meters.

This strategic partnership represents a major milestone for Metersit in Europe and confirms its commitment to delivering innovative, sustainable, and high-quality solutions to the energy sector.

Outlook

For 2025 is expected high single-digit consolidated revenue growth, mainly driven by market share expansion. This growth is anticipated to materialize in the second half of the year, based on existing client agreements.

The product range diversification launched in 2024 within the Heating & Ventilation segment is also expected to gradually support revenue growth.

In addition, positive carry-over effects from the newly implemented industrial footprint and further initiatives starting in 2025 will contribute to enhancing cost efficiency throughout the year.

The adjusted EBITDA margin is expected to return to double digits and will support a further reduction in net financial debt.

The current outlook does not consider recent developments concerning duties and tariffs, or any future adjustments thereto.

Proposal for allocation of the net result

In accordance with IAS 1 provisions and concurrently with the approval for publication of the separate financial statements, the Board of Directors of SIT S.p.A. proposes to the Shareholders’ Meeting to carry forward the net loss for the year, amounting to €38,662,289.

Calling of the Shareholders’ Meeting

At today’s meeting, the Board of Directors also resolved to grant the Chairman of the Board the authority to convene the Ordinary Shareholders’ Meeting, in a single call, to be held on Friday, May 30, 2025, at 10:30 a.m. CEST, to deliberate on the following agenda:

- Approval of the statutory financial statements as of December 31, 2024, including the Balance Sheet, Income Statement, and Explanatory Notes, accompanied by the Management Report, the Board of Statutory Auditors’ Report, and the Independent Auditors’ Report; presentation of the Consolidated Financial Statements as of December 31, 2024, and of the Sustainability Statement for FY 2024; allocation of the net result for the year:

- Approval of the statutory financial statements as of December 31, 2024; presentation of the Consolidated Financial Statements as of December 31, 2024, and of the Sustainability Statement for FY 2024;

- Allocation of the net result for the year; related and resulting resolutions.

- Resolutions on the Report on the Remuneration Policy and on Compensation Paid, pursuant to Article 123-ter of Italian Legislative Decree No. 58/1998 and Article 84-quater of CONSOB Regulation No. 11971/1999

- Binding vote on the Remuneration Policy for FY 2025 as outlined in the first section of the report;

- Advisory vote on the second section of the report concerning the compensation paid in, or related to, FY 2024.

The full Notice of Call and the relevant documentation required under applicable law, including the Explanatory Report prepared by the Board of Directors on the items on the agenda, will be made available to the public — within the legally prescribed timeframe — at the Company’s registered office, on the corporate website www.sitcorporate.it under Corporate Governance → Shareholders’ Meetings, as well as on the websites of Borsa Italiana S.p.A. and the authorized storage mechanism “eMarket Storage”, along with any additional documentation required by law. In compliance with applicable regulations, an extract of the notice will also be published in a national daily newspaper.

Approval of Additional Corporate Documents

During today’s session, the Board of Directors also approved, along with the draft statutory financial statements and the consolidated financial statements for the year ended December 31, 2024: (i) the Sustainability Statement for FY 2024, pursuant to Legislative Decree No. 125/2024; (ii) the Annual Corporate Governance and Ownership Structure Report, pursuant to Articles 123-bis of Italian Legislative Decree No. 58/1998 (“TUF”) and 89-bis of CONSOB Regulation No. 11971/1999 (“Issuers’ Regulation”); (iii) the Report on the Remuneration Policy and Compensation Paid, pursuant to Articles 123-ter of the TUF and 84-quater of the Issuers’ Regulation.

The Annual Consolidated Financial Report as of December 31, 2024, including the Sustainability Statement pursuant to Legislative Decree No. 125/2024, the Corporate Governance Report, and the Remuneration Report will be made available to the public within the time limits and in the manner prescribed by applicable regulations.

***

Declaration of the manager responsible of the preparation of the Company’s accounts

The manager responsible of the preparation of the Company’s accounts, Mr. Paul Fogolin, hereby certifies — pursuant to paragraph 2 of Article 154-bis of the “Testo Unico della Finanza” — that the accounting information contained in this press release are fairly representing the accounts and the books of the Company. This press release and the related results presentation for the period are made available on the website www.sitcorporate.it in the “Investor Relations” section.

Today at 3:00 PM CEST, SIT’s management will hold a conference call to present the Group’s consolidated results for the period to the financial community and the press.

Participation in the call is available at the following link:

Supporting documentation will be published in the “Investor Relations” section of the Company’s website (www.sitcorporate.it) prior to the start of the conference call, as well as on the authorized centralized storage mechanism “eMarket Storage”.

***