Market volatility and uncertainty continues

SIT in H1 2022 returned:

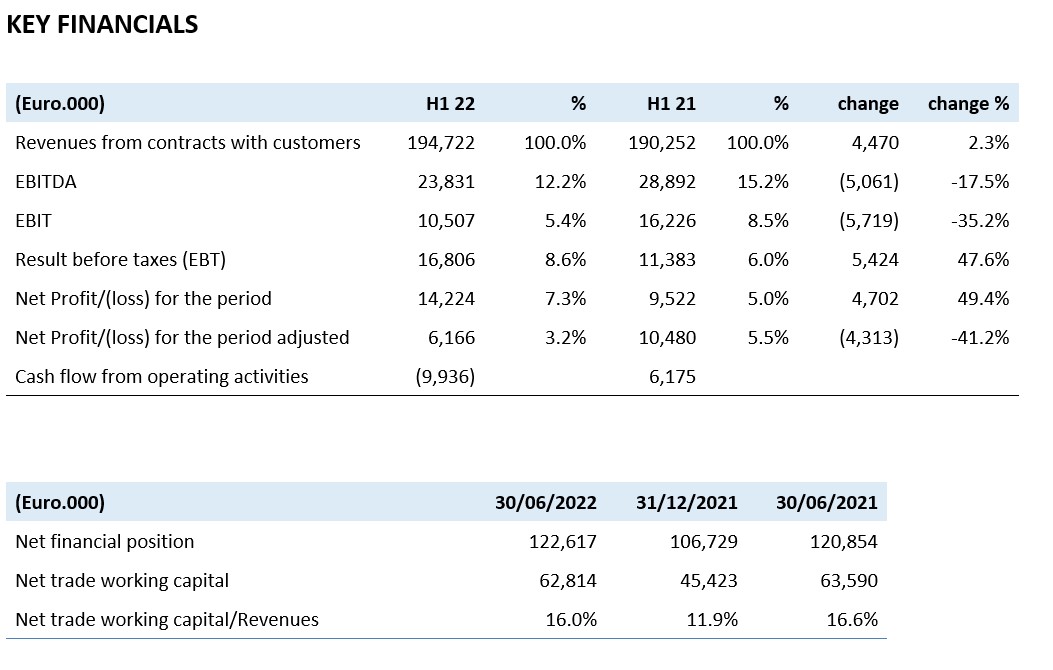

- Consolidated revenues of Euro 194.7 million (+2.3% on H1 2021);

- Heating Division sales of Euro 157.8 million (+9.1% on H1 2021);

- Metering Division sales of Euro 34.1 million (-20.9% on H1 2021), including Smart Gas Metering sales of Euro 21.7 million (-34.7%) and Water Metering sales of Euro 12.5 million (+25.2%);

- Consolidated EBITDA of Euro 23.8 million (-17.5% on H1 2021);

- Consolidated net profit of Euro 14.2 million (7.3% margin), +49.4% on H1 2021;

- Net financial position at June 30, 2022 of Euro 122.6 million (Euro 120.9 million in H1 2021).

Q2 2022 reports:

- Consolidated revenues of Euro 100.9 million (+3.4% on Q2 2021);

- Heating Division sales of Euro 81.8 million (+10.2% on Q2 2021);

- Metering Division sales of Euro 17.6 million (-19.7% on Q2 2021), including Smart Gas Metering sales of Euro 11.4 million (-32.2%) and Water Metering sales of Euro 6.2 million (+21.1%);

- Consolidated EBITDA of Euro 9.2 million (-33.8% on Q2 2021).

- Dividends of Euro 7.3 million paid as per Shareholders’ Meeting motion of April 29, 2022;

***

Padua, August 4, 2022

The Board of Directors of SIT S.p.A., listed on the main market of the Italian Stock Exchange, in a meeting today presided over by Federico de’ Stefani, the Chairperson and Chief Executive Officer, approved the consolidated H1 2022 results.

“The results approved today confirm the achievement of the Group’s growth targets and were delivered in spite of the continue historic levels of uncertainty” stated Federico de’ Stefani, Chairperson and CEO of SIT. “SIT’s core Heating division in particular returned an even stronger Q2, highlighting its capacity to react well to supply chain difficulties, as did the Water Metering division which continues to report very strong growth. For Smart Gas Metering, our winning features focused on innovation based on technology and precision place us ahead of the general market and highlight the expertise of our teams.

We are working, and shall continue to work, on offering our customers an exemplary service and high levels of quality, viewing this relationship as crucial for our medium and long-term competitivity.

2022 is still an open book: the backlog is solid, our revenue objective of approx. Euro 400 million remains, alongside a targeted consolidated margin of between 12% and 13%”.

Operating performance

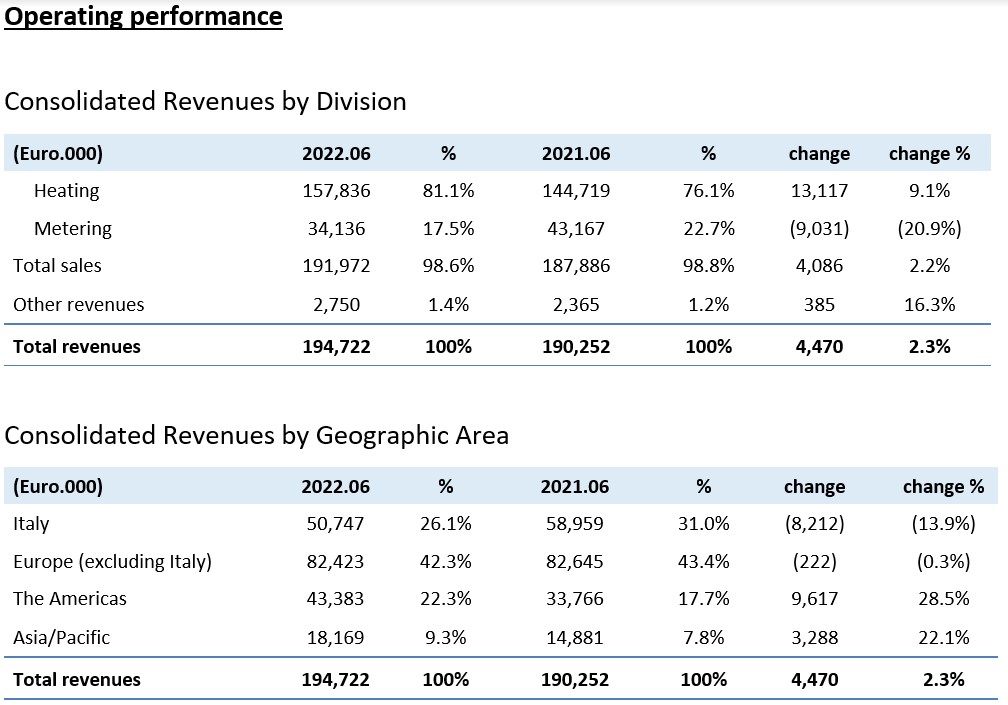

Consolidated Revenues by Division

H1 2022 consolidated revenues were Euro 194.7 million, increasing 2.3% on the same period of 2021 (Euro 190.3 million).

Heating Division sales in the first half of 2022 amounted to Euro 157.8 million, +9.1% compared to Euro 144.7 million in the same period of 2021 (+6.1% at like-for-like exchange rates). In the second quarter, the division’s core sales rose 10.2% to Euro 81.8 million, compared with Euro 74.2 million in the same period of 2021.

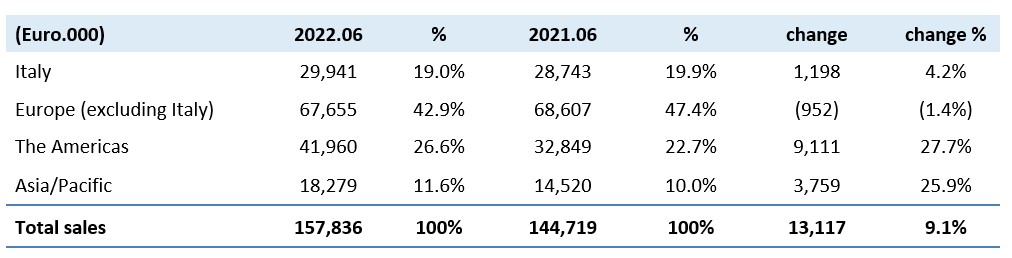

The following table presents Heating Division core sales by region according to management criteria:

Sales in Italy rose 4.2% on H1 2021, thanks to strong demand in the Catering sector (+Euro 1.5 million, +80%) and for Direct Heating, which rose Euro 0.5 million (+15%), on the basis of pellet stoves and space heaters. Central Heating reported a contraction of Euro 0.7 million (-3.6%), mainly due to delays for fans and electronics.

Sales in Europe (excluding Italy) decreased Euro 1.0 million in H1 2022 (-1.4%) on the same period of the previous year. The Central Heating segment in Turkey, the top shipping market with 9.7% of division sales, contracted 8.7% on H1 2021, while the UK, 6.0% of division sales, saw a 22.5% decrease for Central Heating – Flues and Mechanical controls – due to delivery delays to customers of certain components from other suppliers. Central Europe remains strong, thanks to the introduction of new products, up 15.0% on H1 2021 (Euro 3.8 million).

Sales in the Americas rose 27.7% (+17.4% at like-for-like exchange rates), thanks to fireplaces growth of Euro 4.1 million (+25.0%). Storage Water Heating applications in H1 2022 rose 14.2% (Euro 1.5 million). Central Heating applications also grew, increasing Euro 2.8 million (+60%).

Asia/Pacific sales were up 25.9% to Euro 18.3 million (Euro 14.5 million in H1 2021). Growth was reported in China (6.9% of the division), up +15.9% (+Euro 1.5 million) as a result of the Central Heating retail market recovery, and in Australia – improving Euro 0.7 million (+18.9%).

Among the main product families, Mechanical controls sales were up (+8.9%, +Euro 7.4 million), as were Electronic controls (+25.5%, Euro 6.9 million) and Fans (+2.6%, Euro 0.5 million), with the production of this latter family now on schedule after the procurement difficulties in Q1. At the application segment level, Central Heating accounted for 57.6% of division sales, increasing 6.9%, while Direct Heating (19.2% of the division sales) rose 13.8% due to the positive fireplaces market in the USA and for applications sold in Italy.

Metering Division sales were Euro 34.1 million (Euro 43.2 million, reducing 20.9% on the same period of the previous year).

In H1 2022, sales in the Smart Gas Metering sector totalled Euro 21.7 million, reducing 34.7% on the first half of 2021. Sales in Italy accounted for 92.8% of the total, while overseas sales accounted for 7.2% (from Greece, Central Europe, the UK and India).

Water Metering sales totalled Euro 12.5 million, up 25.2% on H1 2021. Portugal accounts for 23.9% of sales, Spain for 28.4%, the rest of Europe for 34.9% and America and Asia respectively for 6.8% and 5.9%.

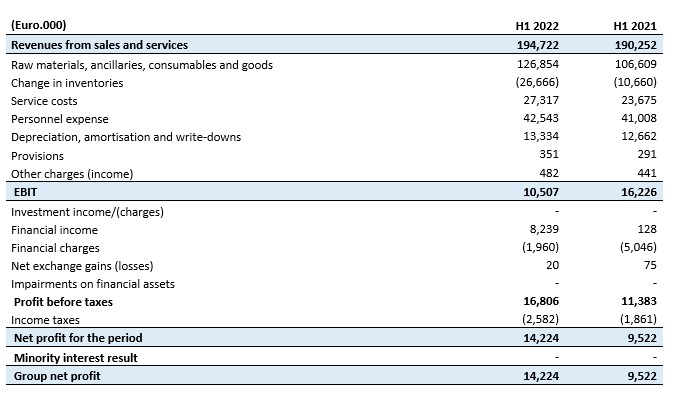

H1 2022 EBITDA was therefore Euro 23.8 million (12.2% revenue margin), decreasing 17.5% on Euro 28.9 million (15.2% margin) in the first half of 2021.

The impact of volumes is negative for Euro 4.7 million, while the net contribution of prices is positive for Euro 4.1 million, as the increased cost of components and raw materials in the period was transferred to the market. Operating costs increased Euro 6.7 million, particularly due to the impact of logistics and transport costs (increasing by approx. Euro 3.0 million) and increased R&D and production costs. EBITDA benefitted from exchange gains of Euro 1.8 million.

EBIT in H1 2022 totalled Euro 10.5 million (5.4% margin), after amortisation, depreciation and write-downs of Euro 13.3 million. EBIT in the previous year totalled Euro 16.2 million (8.5% margin).

Net financial income of Euro 6.3 million was reported in H1 2022, due to the positive effect from the change in the fair value of the warrants issued by the company (Euro 8.1 million). Adjusted net financial charges totalled Euro 1.8 million (0.9% of revenues), reducing on the same period of the previous year (Euro 2.2 million, 1.1% of revenues).

Pre-tax profit was Euro 16.8 million (8.6% revenue margin) compared to Euro 11.4 million (6.0% margin) in the same period of 2021.

The net profit for the period was Euro 14.2 million (7.3% margin), compared to Euro 9.5 million in H1 2021, which included the positive impact of the extraordinary tax income of Euro 1.8 million relating to the Patent Box.

Net of non-recurring charges and income, the adjusted net profit in H1 2022 was Euro 6.2 million, compared to Euro 10.5 million in the same period of the previous year (3.2% and 5.5% of revenues respectively).

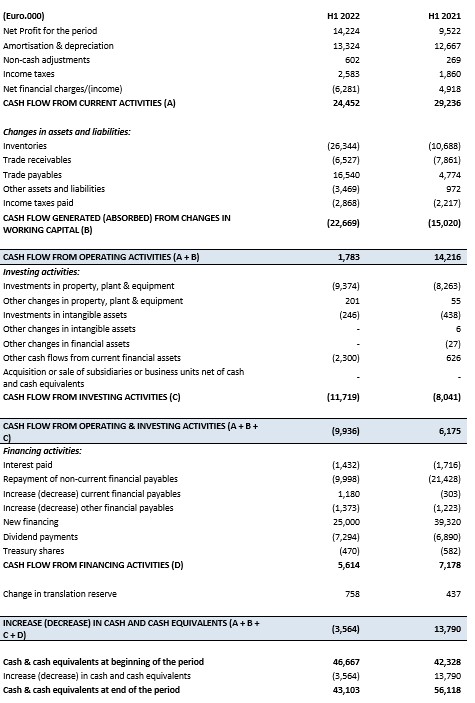

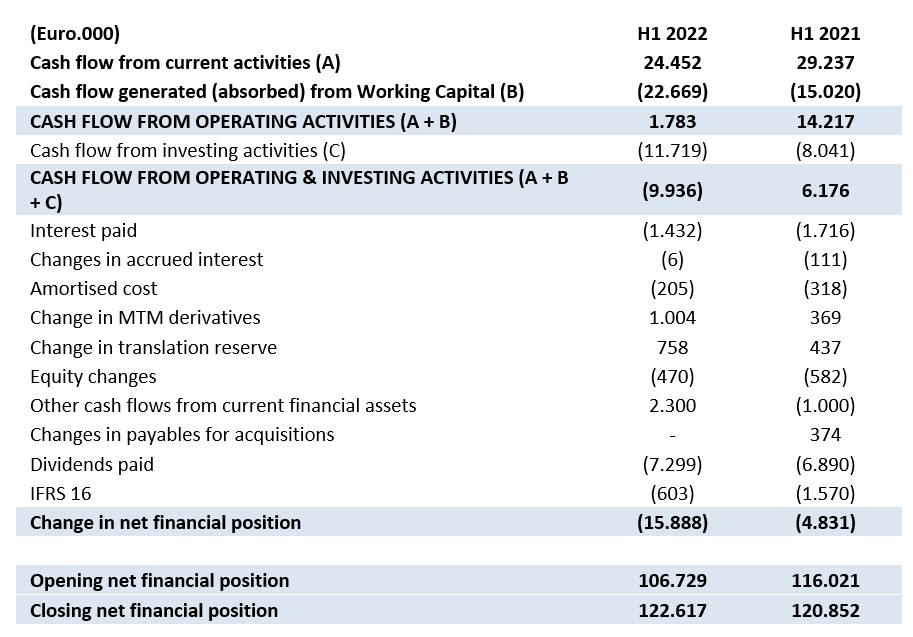

Cash Flow performance

The net financial debt at June 30, 2022 was Euro 122.6 million, compared to Euro 120.9 million at June 30, 2021.

The movements in the net financial position are reported below:

Cash flows from operating activities of Euro 24.5 million were generated in the first half of the year, with an absorption as a result of the increase in working capital of Euro 22.7 million, of which Euro 26.3 million due to increased inventories on the basis of the electronic component procurement policy to offset the impact of shortages and guarantee service to customers.

Investing activities absorbed cash of Euro 11.7 million, compared to Euro 8.0 million in the same period of the previous year.

Cash flows from operating activities after investments of Euro 9.9 million were therefore absorbed in the period, compared to a generation of Euro 6.2 million in H1 2021.

Financing activity cash flows in the period included interest of Euro 1.4 million and dividends of Euro 7.3 million; the IFRS 16 impact was Euro 0.6 million.

The net financial position at June 30, 2022 was Euro 122.6 million, increasing Euro 15.9 million on December 31, 2021 (Euro 106.7 million).

Subsequent events to the end of the period

There were no significant events subsequent to period-end.

Outlook

The 2022 full-year forecasts, taking into account currently foreseeable developments, indicate consolidated sales growth of between 3% and 5% over 2021.

In light of the continuing instability of the procurement markets, in addition to logistics and energy cost movements, an EBITDA margin of between 12% and 13% is expected.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company. This press release and the results presentation for H1 2022 are available on the website www.sitcorporate.it in the Investor Relations section.

***

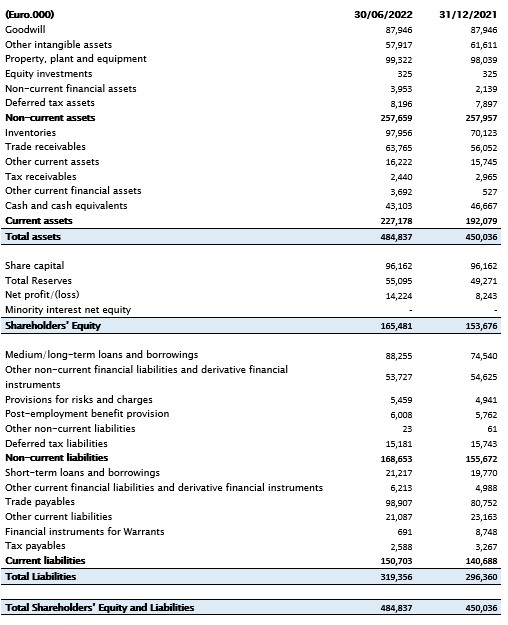

Annex 1

BALANCE SHEET

Annex 2

INCOME STATEMENT

Annex 3

CASH FLOW STATEMENT