Increased Heating division sales in all regions, water meters business grows.

CEO de’ Stefani: “In 2022 we are targeting higher sales and guaranteed service to customers”

SIT for Q1 2022 reports:

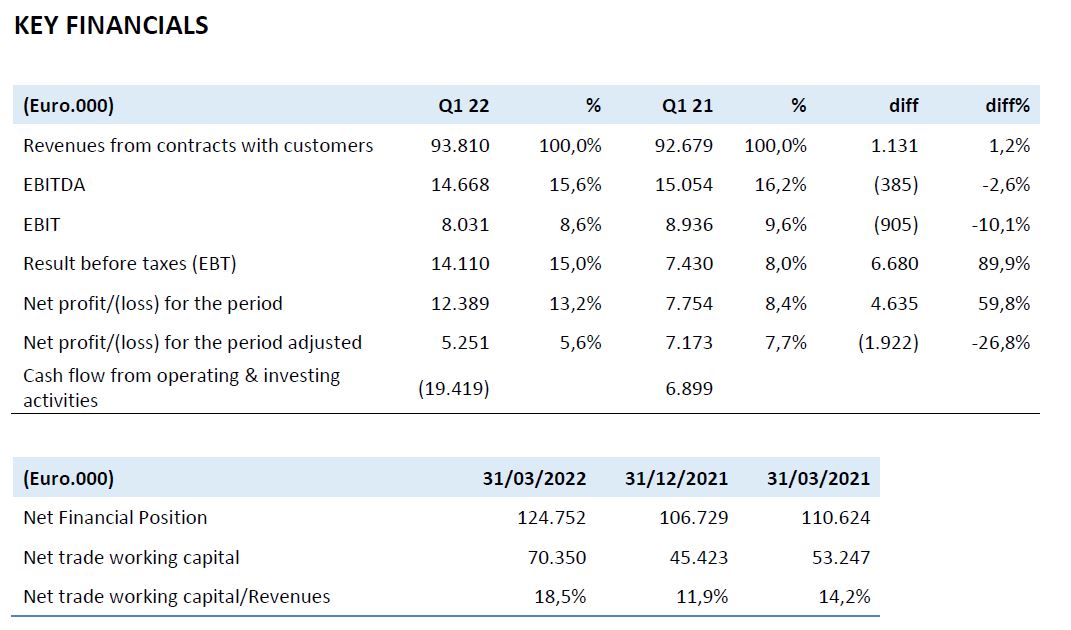

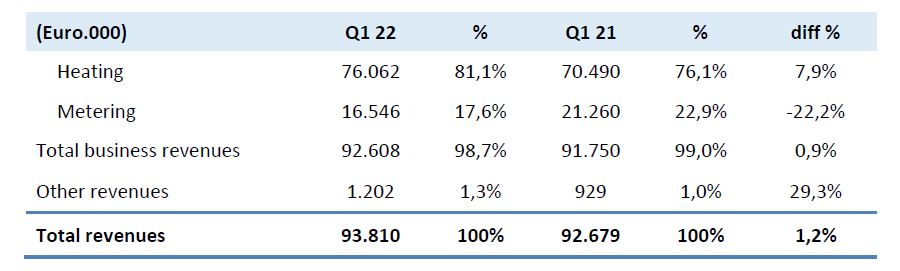

- Consolidated revenues of Euro 93.8 million (+1.2% on Q1 2021);

- Heating Division sales of Euro 76.1 million (+7.9% on Q1 2021);

- Metering Division sales of Euro 16.5 million (-22.2% on Q1 2021), including Smart Gas Metering sales of Euro 10.3 million and Water Metering sales of Euro 6.2 million;

- Consolidated EBITDA of Euro 14.7 million (15.6% margin), compared to Euro 15.1 million in Q1 2021 (16.2% margin);

- Consolidated net profit of Euro 12.4 million (13.2% margin), +59.8% on Q1 2021;

- Net financial position at March 31, 2022 of Euro 124.8 million (Euro 110.6 million in Q1 2021).

***

Padua, May 11, 2022

The Board of Directors of SIT S.p.A., listed on the main market of the Italian Stock Exchange, in a meeting today presided over by Federico de’ Stefani, the Chairperson and Chief Executive Officer, approved the consolidated Q1 2022 results.

“SIT reports consolidated revenue growth for the first quarter – despite the continuing Russia-Ukraine conflict and the lack of components available – thanks to a major push by the entire team,” noted Federico de’ Stefani, Chairman and CEO of SIT. “The Group’s core Heating division saw an excellent performance, particularly in Asia/Pacific. The expected Smart Gas Metering contraction was sharper, on the domestic market, due to the scarcity of certain components, and due to the still marginal overseas market revenues. The new Water Metering business performed well, supported by our incisive strategy to develop and protect water resources through advanced technologies and new solutions.

For 2022, we confirm sales growth, with the Group expected to close near the Euro 400 million revenue barrier in the year. Our strategy will continue to centre on the servicing of customers. The Group shall therefore continue to invest resources to support the new production footprint designed over recent months”.

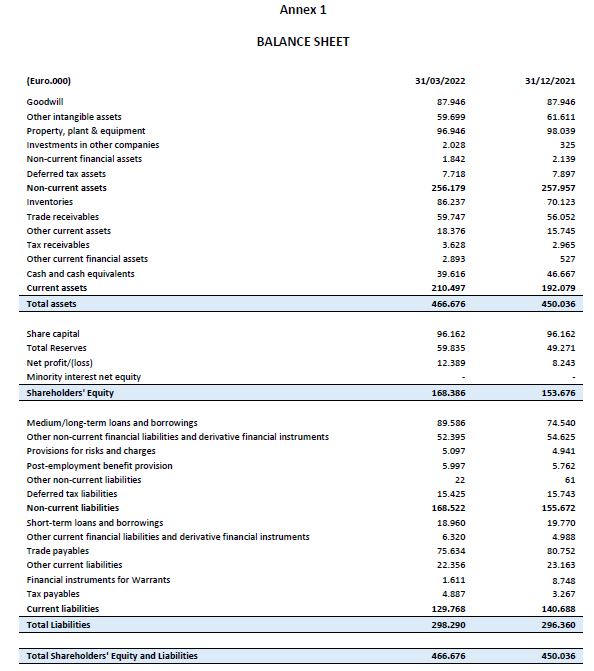

Q1 2022 consolidated revenues were Euro 93.8 million, up 1.2% on the same period of 2021.

Q1 consolidated revenues are presented in the following table:

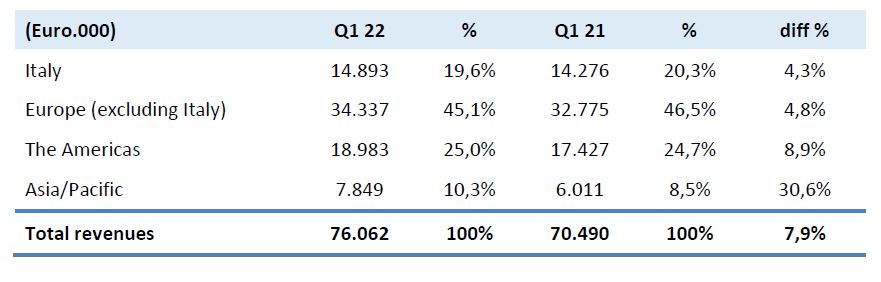

Heating Division sales amounted to Euro 76.1 million, compared to Euro 70.5 million in Q1 2021 (+7.9%).

The geographic distribution of Heating Division sales was as follows:

Sales in Italy rose 4.3% on Q1 2021, thanks to strong demand in the Catering sector (+Euro 1.0 million, +130%) and for Direct Heating, which rose Euro 0.5 million (+35%), on the basis of pellet stoves and space heaters. Central Heating reported a contraction of Euro 1.1 million (-11.0%), mainly due to delays for fans and electronics.

Sales in Europe (excluding Italy) were up Euro 1.6 million in Q1 2022 (+4.8%) on the same period of the previous year. Turkey, the top shipping market with 10.8% of division sales, performed in line with Q1 2021, while the UK, 7.2% of division sales, reported a contraction of 10.1% due to delivery delays to customers of certain components from other suppliers. Central Europe remains strong, thanks to the introduction of new products, up 30.0% on Q1 2021 (Euro 1.5 million). The Russian market, accounting for 4.1% of division sales, reported a reduction of 10.4% on Q1 2021.

Sales in the Americas rose 8.9% (+2.9% at like-for-like exchange rates), thanks to fireplaces growth of Euro 1 million (+11.1%). Storage Water Heating applications in Q1 2022 declined 11.4% (-Euro 0.8 million).

Asia/Pacific sales were up 30.6% to Euro 7.8 million (Euro 6.0 million in Q1 2021). Growth was reported in China (6.4% of the division), up 37.9% (+Euro 1.3 million) as a result of the Central Heating retail market recovery, and in Australia – improving Euro 0.8 million (+49.5%).

Among the main product families, Mechanical controls sales were up (+10.3%, +Euro 4.1 million), as were Electronic controls (+9.3%, Euro 1.3 million) and flue products (+6.6%). Fans were down (-1.9%) due to component procurement difficulties. At the application segment level, Central Heating accounted for 58.9% of division sales, increasing 9.0%, while Direct Heating (17.1% of the division sales) rose 7.3% due to the strong fireplaces market in the USA and for applications sold in Italy.

Metering Division sales were Euro 16.5 million (Euro 21.3 million, reducing 22.2% on the same period of the previous year).

In Q1 2022, sales in the Smart Gas Metering sector totalled Euro 10.3 million, reducing 37.3% on the first quarter of 2021. Sales in Italy accounted for 90.7% of the total, while overseas sales accounted for 9.3% (from Greece, Central Europe, the UK and India).

Water Metering sales totalled Euro 6.2 million, up 29.5% on Q1 2021. Finished product sales accounted for 46.1% of the total, while component sales accounted for 47.7%.

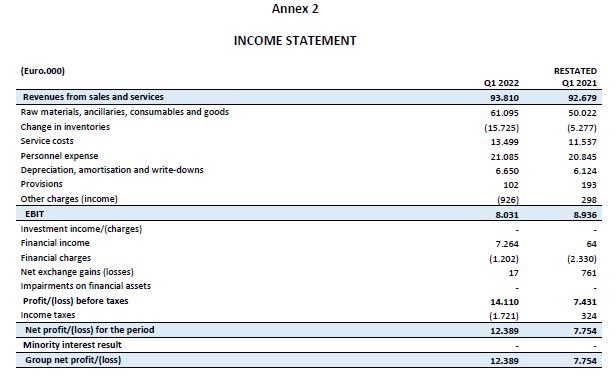

Q1 2022 EBITDA was therefore Euro 14.7 million (15.6% revenue margin), decreasing 2.6% on Euro 15.1 million (16.2% margin) in the first quarter of 2021.

The impact of volumes is negative for Euro 0.5 million, while the net contribution of prices is positive for Euro 1.9 million, as the increased cost of components and raw materials was transferred to the market. Operating costs increased Euro 3.2 million, particularly due to the impact of logistics and transport costs and increased R&D and production costs. Exchange gains of Euro 1.1 million were reported.

Q1 2022 EBIT was therefore Euro 8.0 million, decreasing 10.1% on Euro 8.9 million in Q1 2021 (8.6% and 9.6% respectively).

Net financial income of Euro 6.1 million was reported in Q1 2022, due to the positive effect from the change in the fair value of the warrants issued by the company (Euro 7.1 million). Adjusted net financial charges totalled Euro 1.1 million (1.1% of revenues), reducing on the same period of the previous year (Euro 1.2 million, 1.3% of revenues).

Pre-tax profit was Euro 14.1 million (15.0% revenue margin) compared to Euro 7.4 million (8.0% margin) in the same period of 2021.

The net profit for the period was Euro 12.4 million (13.2% margin), compared to Euro 7.8 million in Q1 2021, which included the positive impact of the extraordinary tax income of Euro 1.8 million relating to the Patent Box.

Net of non-recurring charges and income, the adjusted net profit in Q1 2022 was Euro 5.3 million, compared to Euro 7.2 million in the same period of the previous year (5.6% and 7.7% of revenues respectively).

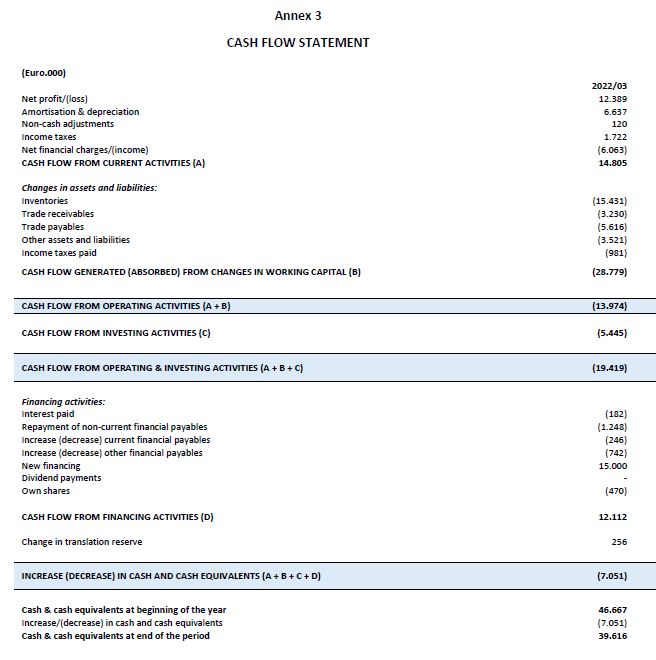

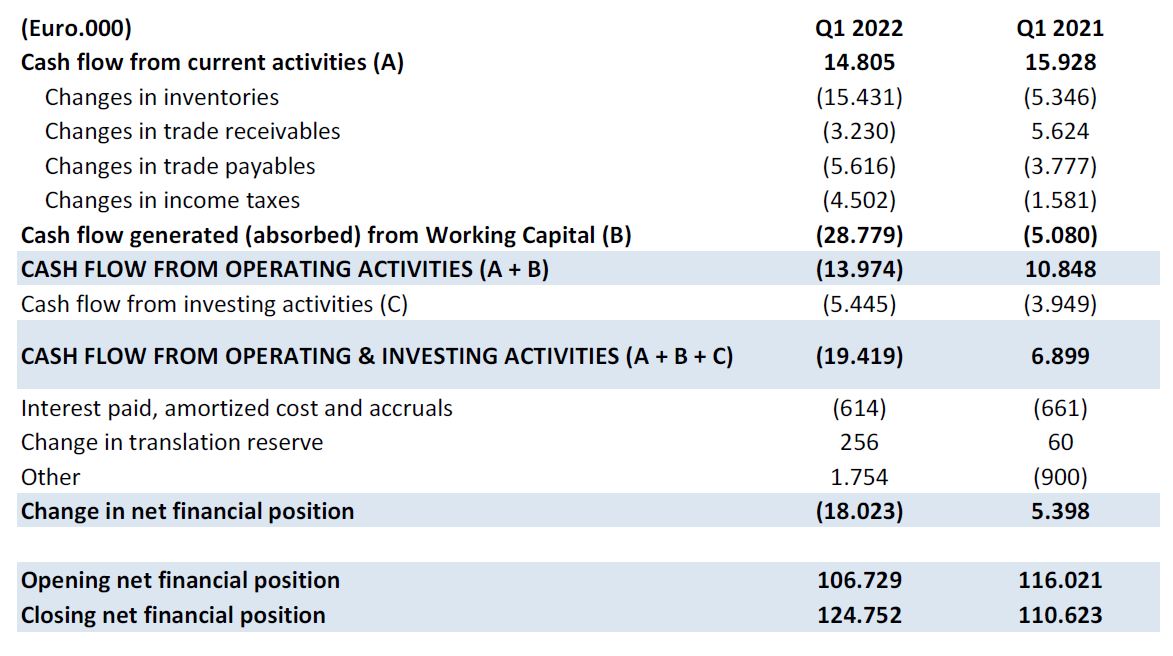

Cash flows in the first quarter are presented in the following table:

Cash flows were absorbed in the period as a result of the increase in working capital of Euro 28.8 million, of which Euro 15.4 million due to increased inventories on the basis of the electronic component procurement policy to offset the impact of shortages and guarantee service to customers.

Investing activities absorbed cash of Euro 5.4 million, compared to Euro 3.9 million in the same period of the previous year.

Cash flows from operating activities after investments of Euro 19.4 million were therefore absorbed in the period, compared to a generation of Euro 6.9 million in Q1 2021.

Net debt amounted to Euro 124.8 million at March 31, 2022, compared to Euro 106.7 million at December 31, 2021 and Euro 110.6 million at March 31, 2021.

Outlook

The industrial sector as a whole currently features a range of uncertainties both at geopolitical and general economic level.

With regards to SIT and the impacts from the Russia/Ukraine crisis, the production of electronic boards for the Heating sector is proceeding as normal at the plant of the US multinational supplier located near Ukraine’s western border, while the plan to insource boards has begun on schedule.

The electronic component shortage continues, driving inflation and irregular supply, which is considered in addition to the logistical difficulties stemming from the strict lockdowns applied by the Chinese authorities to manage COVID. The SIT Group’s response has been to introduce a procurement policy independent of production scheduling so as to guarantee service to customers.

Considering that currently foreseeable, we confirm at consolidated level expected sales growth between 4 and 5% on 2021FY and profitability (EBITDA margin) of approx. 13%.

Finally, the Group strongly confirms its utmost commitment to achieving the objectives set out in the Made to Matter” Sustainability Plan presented on May 4, 2022.

Share buy-back programme

In execution of the authorisation granted by the Shareholders’ Meeting of April 29, 2022, the Board of Directors of SIT today approved the launch of a share buy-back programme, the duration, value and maximum quantity of which were established by the Shareholders’ Meeting.

The Board of Directors approved implementation of the programme for the purchase and disposal of treasury shares for the following purposes:

- to fulfil the obligations arising from share option programmes or other allocations of shares to employees (including any classes which, in accordance with the applicable legislation, are treated as such), to members of the administrative or control bodies of the issuer or of an associated company that the Company wishes to incentivize and retain, and to the members of the Advisory Board;

- to carry out sales, exchanges, conferments or other utilisations of treasury shares for the acquisition of investments and/or buildings and/or the conclusion of contracts (also commercial) with strategic partners and/or for the completion of industrial projects or extraordinary financial operations, which are considered necessary within the Company or Group expansion plans; and

- to support the liquidity of the share, ensuring fluid trading and preventing price movements not in line with the market.

The purchases will be carried out, also through subsidiaries, in accordance with Article 132 of Legislative Decree 58/98 (CFA), Article 144-bis of the Issuers’ Regulations and all applicable regulations, in addition to Consob permitted practices.

The maximum number of treasury shares that may be purchased may not exceed 10% of the Company’s pro tempore share capital (also taking into account the treasury shares held by the Company and its subsidiaries).

The maximum number of treasury shares that may be purchased daily may not exceed 25% of the average daily number of shares traded on the market during the previous 20 days, in accordance with the applicable regulations.

With reference to the minimum and maximum price, no purchases of ordinary treasury shares may be made at a unit purchase price (i) at least 20% lower than the reference price that the share records in the session of the day prior to each individual purchase transaction and (ii) higher than the highest price between the price of the last independent transaction and the price of the highest current independent purchase offer on the same market, in accordance with the provisions of Article 3 of EU Delegated Regulation No. 2016/1052, it being understood that, in relation to disposals, this price limit may be waived in the case of exchanges or sales of treasury shares as part of the execution of industrial and/or commercial projects and/or in any case of interest to the Company, and in the case of sales of shares in execution of incentive plans.

The authorisation granted by the aforementioned Shareholders Meeting motion will be effective for a period of 18 months from the date of the motion, i.e. until October 29, 2023.

Conference call with the financial market for the presentation of the results as of 31st of March 2022

The results as of 31st of March 2022. will be presented today to the financial market by SIT management via online stream at 04:00 pm CEST (at meet.google.com/qct-atzc-cpu). The relevant documents will be published in the “Investors Relations” section of the Company’s website (www.sitcorporate.it) before the conference call.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company. This press release and the results presentation for Q1 2022 are available on the website www.sitcorporate.it in the Investor Relations section.

***