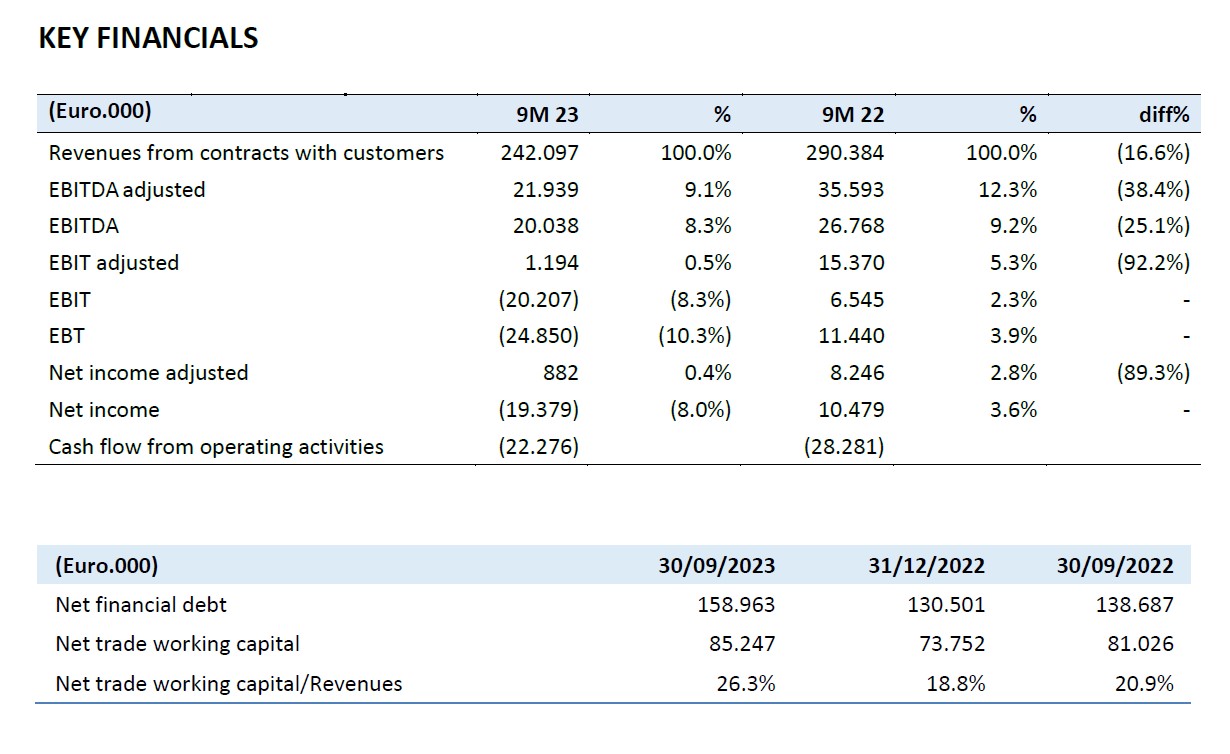

In the first nine months of 2023, SIT achieved:

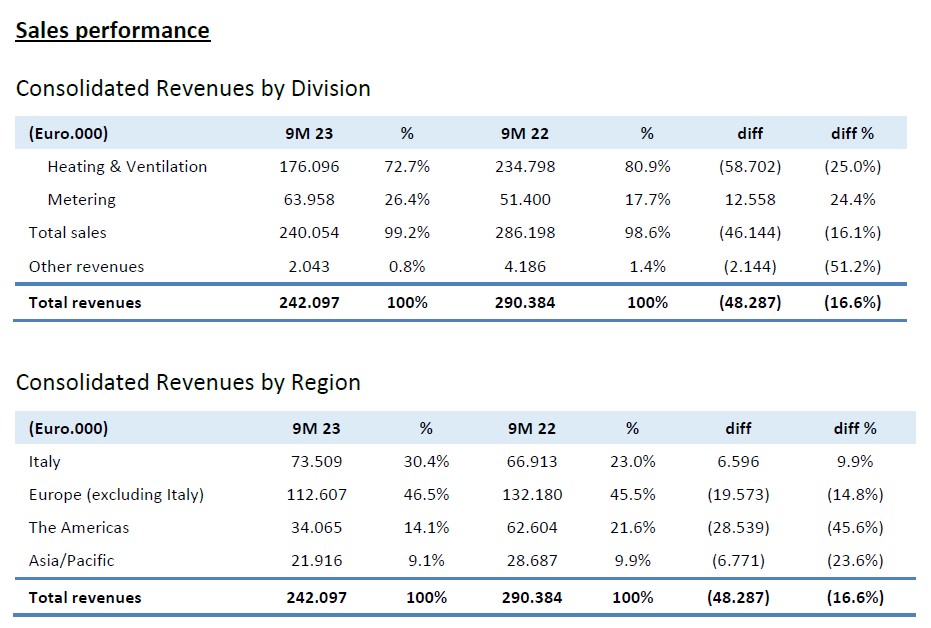

- Consolidated revenues of Euro 242.1 million (-16.6% compared to the first nine months of 2022);

- Sales of the Heating & Ventilation Division of Euro 176.1 million (-25.0% compared to the same period of 2022);

- Sales of the Metering Division of Euro of Euro 0 million (+24.4% compared to the same period of 2022), of which Smart Gas Metering for Euro 44.5 million (+34.7%) and Water Metering for Euro 19.5 million (+5.9%);

- Consolidated adjusted EBITDA of Euro 21.9 million (-38.4% compared to the same period of 2022);

- Consolidated adjusted net profit of Euro 0.9 million, 0.4% of revenues, compared to Euro 8.2 million in the first nine months of 2022, equal to 2.8% of revenues;

- Impairment of Heating & Ventilation goodwill of Euro 17.0 million in light of the expected macrotrend in the sector;

- Consolidated net profit of Euro -19.4 million compared to Euro 10.5 million in the first nine months of 2022;

- Cash flow from operation for the first nine months of 2023 amounted to Euro -22.3 million after investments of Euro 16.6 million;

- Net financial position of Euro 159.0 million (Euro 138.7 million at September 30, 2022).

In the third quarter of 2023, the results are:

- Consolidated revenues of Euro 75.2 million, -21.4% compared to the same quarter of 2022;

- Sales of the Heating & Ventilation Division of Euro 52.7 million, -31.5% compared to the third quarter of 2022;

- Metering Division sales of Euro 21.6 million, +25.2% compared to the third quarter of 2022, of which Smart Gas Metering sales of Euro 14.9 million (+31.9%) and Water Metering of Euro 6.7 million (+12.2%).

***

Padova, 9 November 2023 – The Board of Directors of SIT S.p.A., a company listed on the Euronext Milan segment of the Italian Stock Exchange, at today’s meeting chaired by Federico de’ Stefani, Chairman and Chief Executive Officer of SIT, approved the consolidated results for the first nine months of 2023.

Federico de’ Stefani, Chairman and CEO of SIT, commented:

“The third quarter of 2023 confirms the fundamental trends of the sectors in which we operate. In the first 9 months of the year, the performance of the Metering Division was particularly strong, with year-on-year growth of close to 25%. This is thanks to the group’s good positioning in the Italian market, the new development projects of the Smart Gas Metering division and the positive quarterly results of Water Metering.

In order to improve profitability levels, the group is implementing its cost containment strategies, which are largely structural. We expect results in this regard starting from 2024, but we can already observe partial improvements given by the actions activated so far. Part of this programme is the start of the negotiation procedure for the downsizing of our production facilites in the Netherlands.

Finally, on the R&D front, we are working on various projects, including international ones, which will allow the group to enter segments that are not yet covered, including heat pumps”.

Consolidated revenues for the first nine months of 2023 amounted to Euro 242.1 million, with a decrease of 16.6% compared to the same period of 2022 (Euro 290.4 million).

Heating & Ventilation Division

Sales of the Heating & Ventilation Division in the first nine months of 2023 amounted to Euro 176.1 million, -25.0% compared to Euro 234.8 million in the same period of 2022 (-24.4% at constant exchange rates).

Also in the third quarter of 2023, the Heating end market was in sharp contraction compared to the previous year, due both to the interruption of sector incentives and the uncertainty of the legislative framework relating to gas appliances. The impact of inflation and high interest rates on the spending power of households also contributed to the contraction.

In this market context, SIT customers are operating with stock levels that are still consistent because of the 2022 demand dynamics and established in the past to cope with the uncertainties arising in the supply chain, especially in electronics.

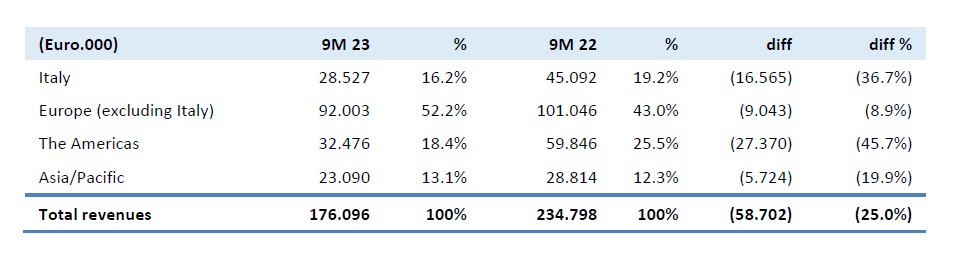

The following table shows sales breakdown by geography of the Heating & Ventilation Division according to management accounting criteria:

Sales in Italy decreased by 36.7% compared to the same period of 2022. This trend affected all the main product families and was driven by changes in sector incentives as well as the slowdown in home renovations. It is worth noting the particularly negative trend in the Direct Heating segment, of applications for Pellet Stoves (-76.0%) which in 2022 had benefit,ted from the sharp increase in gas prices.

As far as Europe, excluding Italy, is concerned in the first nine months of 2023 there was a reduction in sales of Euro 9.0 million, equal to 8.9% compared to the same period of the previous year. Turkey, the leading shipping market with 18.9% of divisional sales, recorded a growth trend of 32.9% equal to Euro 8.3 million, mainly thanks to Fans for Central Heating applications, that were penalized by supply problems in the same period of 2022. UK, 8.1% of divisional sales, marks a trend in the first nine months of 2023 substantially in line with the same period of 2022, noting a different trend between product families with a growth of Euro 2.0 million (+29.4%) in Flues compared to the same period of 2022. As for Central Europe, the overall trend in the period was in line with the Division (-28.1%), with sales of Heat Recovery Units increasing by Euro 1.1 million, +13.8% compared to the same period of 2022.

Sales in America fell by 45.7% (exchange rate impact is not material). The reduction affected Storage Water Heating applications for Euro 8.6 million, while Direct Heating applications for fireplaces (-18.8 million Euros. -56.4%) were affected by the negative trend of new buildings to which this segment is related.

Sales in the Asia/Pacific area decreased by 19.9% (-14.8% on a like-for-like exchange rate basis) to Euro 23.1 million in the nine months compared to Euro 28.8 million in the same period of 2022. As for China, sales in the third quarter decreased by 12.9% compared to the same period of 2022, bringing sales for the nine months to -15.1% (-8.6% on a like-for-like exchange rate basis). In the first nine months of 2023, Australia recorded sales of Euro 4.8 million, down 28.3% (23.3% at constant exchange rates).

Metering Division

Sales in the Metering Division amounted to Euro 64.0 million compared to Euro 51.4 million, with an increase of 24.4% compared to the same period of the previous year.

In the first nine months of 2023, sales in the Smart Gas Metering segment amounted to Euro 44.5 million. up 34.7% compared to the first nine months of 2022. The performance is due to the group’s good positioning in the Italian market and the new development and replacement projects launched by its main customers. Sales in Italy accounted for 95.8% of the total, while sales abroad, equal to 4.2% of the total, were made in Greece and Central Europe.

Sales in Water Metering amounted to Euro 19.5 million, up 5.9% compared to the first nine months of 2022. Sales were achieved in Portugal (18.6%), Spain (38.4%), the rest of Europe (32.2%) and America and Asia (7.6% and 3.0% respectively).

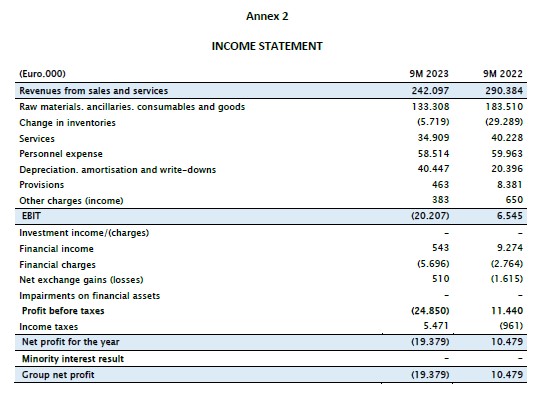

Economic performance

Consolidated revenues for the first nine months of 2023 amounted to Euro 242.1 million, recording a decrease of 16.6% compared to the same period of 2022 (Euro 290.4 million).

Adjusted EBITDA amounted to Euro 21.9 million, down 38.4% compared to the same period of the previous year (Euro 35.6 million) and was affected by the volume effect, especially in the Heating & Ventilation division, only partially offset by the Metering division and by efficiency and cost containment measures.

Adjusted EBIT is equal to Euro 1.2 million (0.5% of revenues) compared to Euro 15.4 million (5.3% of revenues) in the first nine months of 2022.

The goodwill impairment of Euro 17.0 million, already reported in the half-year financial statements, was carried out considering the trend and scenarios envisaged in the use of gas appliances in domestic heating as a result of the energy transition.

The group’s operating result (EBIT) was particularly affected by the impairment test and went from Euro 6.5 million in the first nine months of 2022 to Euro -20.2 million in the first nine months of 2023.

Net financial expense for the first nine months of 2023 amounted to Euro 5.2 million compared to net financial income of Euro 6.5 million in the same period of the previous year. It should be noted that in the first nine months of 2022 the amount was influenced by the change in fair value deriving from the market value of the Warrants, which resulted in a financial gain of Euro 8.7 million.

Adjusted net financial expense, net of the non-recurring items, amounted to Euro 5.2 million in the first nine months of 2023, compared to Euro 2.2 million in the same period of the previous year.

Taxes for the period amounted to Euro 5.5 million and reflect the accrual of deferred tax assets deriving from recoverable tax losses accounted by certain foreign companies.

The net result for the period amounted to a loss of Euro 19.4 million compared to a profit of Euro 10.5 million in the same period of 2022.

The adjusted net result, net of non-recurring effects and write-downs of assets described above, amounted to Euro 0.9 million (0.4% of revenues) compared to Euro 8.2 million (2.8%) in the same period of 2022.

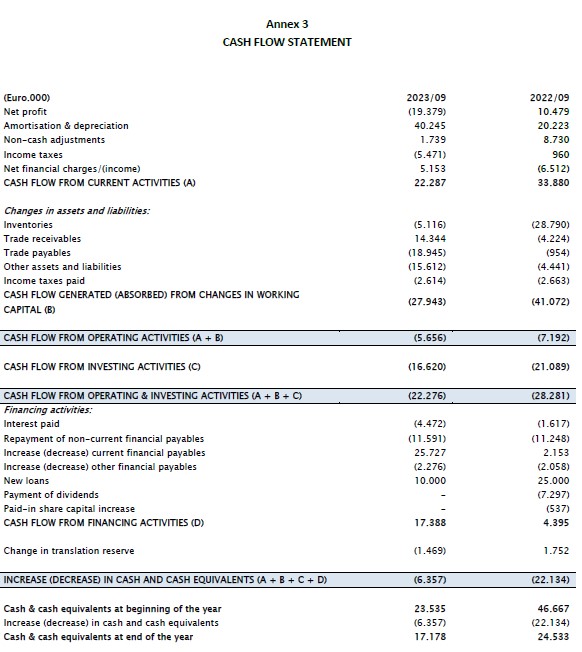

Financial performance

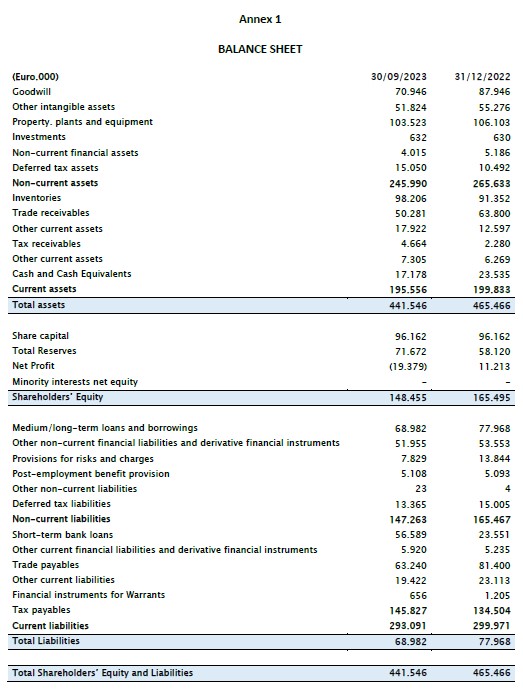

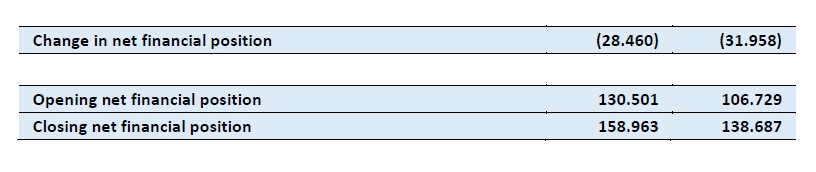

As of September 30, 2023, net financial debt amounted to Euro 159.0 million compared to Euro 130.5 million as of December 31, 2022 and Euro 138.7 million as of September 30, 2022.

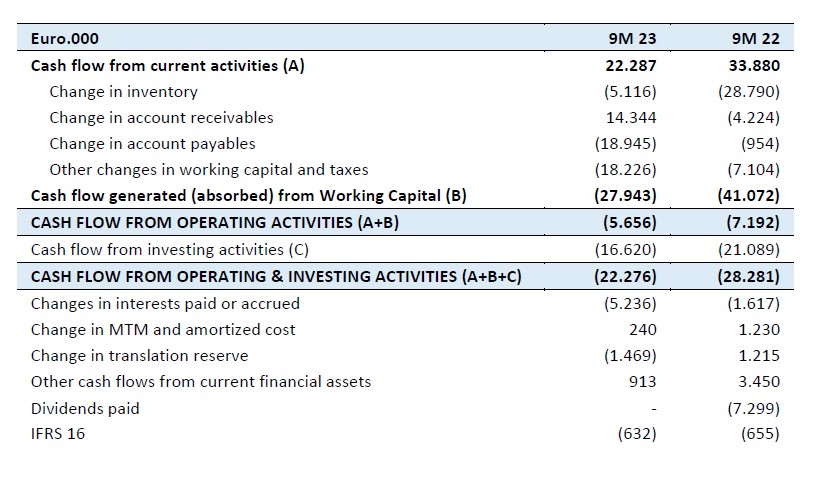

The change in the net financial position is shown in the table below:

Cash flows for the first nine months of 2023 show the generation from current activities of Euro 22.3 million, compared to Euro 33.9 million in the same period of 2022.

In the first nine months of 2023, the absorption of working capital amounted to Euro 27.9 million compared to Euro 41.1 million. It should be noted that in the first quarter of 2023 settlement took place following the agreement reached during the third quarter of 2022 for the non-recurring dispute with a customer.

With regard to trade working capital, in the first nine months of 2023 there was a cash absorption of Euro 9.7 million, partly due to the increase in inventories in Smart Gas Metering to meet the order book in the second half of the year, and partly due to the reduction in the volumes of activities recorded in Heating & Ventilation in both trade receivables and payables. In the same period of 2022, the trend in trade working capital had recorded an absorption of Euro 34.0 million, mainly due to the trend in inventories for the expected sales volumes in Heating & Ventilation.

Investment flows amounted to Euro 16.6 million compared to Euro 21.1 million in the same period of 2022.

Cash flows from operations after investments therefore amounted to Euro -22.3 million compared to Euro -29.3 million in the same period of previous year.

Financial cash flows included interest of Euro 5.2 million in the period compared to Euro 1.6 million in the same period of 2022.

Significant events occurred after the closing of the reporting period.

The Company informs that today the Dutch subsidiary has begun the formal request to the competent employee participation body for consultation regarding the downsizing of the local production facility. The timing of the procedure will be defined according to local legislation while the overall project is expected to be completed in the first half of 2024.

Business Outlook

The Company confirms the 2023 outlook provided in the financial results reporting for the first half of 2023. Smart Gas Metering will maintain double-digit growth (20% ≈ 25%) while Water Metering is expected to grow between 10% and 15%. Considering the market trends in the Heating sector (such as uncertain regulation, the cancellation of incentives, the impact of inflation and high rates on the spending power of households) and the consequent excess stock in the whole value chain that makes destocking longer than expected, it is forecasted that the Heating & Ventilation division will record a reduction compared to the previous year between 25% and 30%.

At a consolidated level, the sales trend in the year compared to the previous year is expected to fall between 18% and 21%.

Adjusted EBITDA as at 31.12.2023 is expected to be between 9 and 10%. Net financial debt is forecasted in line with the first half of 2023, amounting to approximately Euro 150.0 million.

***

Declaration of the manager responsible for the preparation of the Company’s accounts

The manager responsible for the preparation of the Company’s accounts, Paul Fogolin, hereby declares, as per article 154-bis, paragraph 2, of the “Testo Unico della Finanza”, that all information related to the Company’s accounts contained in this press release are fairly representing the accounts and the books of the Company. This press release and the results presentation for the period are available on the website www.sitcorporate.it/en/ in the Investor Relations section.

Today at 3PM CET, SIT management will hold a conference call to present to the financial community and the press the Q3 2023 consolidated results. You may participate in the conference call by connecting to the following link: https://rb.gy/qru7jw

The support documentation shall be published in the “Investor Relations” section on the company website (www.sitcorporate.it) before the conference call.

***